Rental Income Allowable Expenses . Rates you pay to a local authority for the property. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. Find out the 12 categories of. expenses for a let of a year or less can be deducted. This article covers 25 common allowable expenses, such. Rents you pay for property such as ground rents. The normal legal and professional fees incurred on the renewal of a lease are. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a.

from db-excel.com

The normal legal and professional fees incurred on the renewal of a lease are. Find out the 12 categories of. This article covers 25 common allowable expenses, such. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. Rents you pay for property such as ground rents. expenses for a let of a year or less can be deducted. Rates you pay to a local authority for the property. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more.

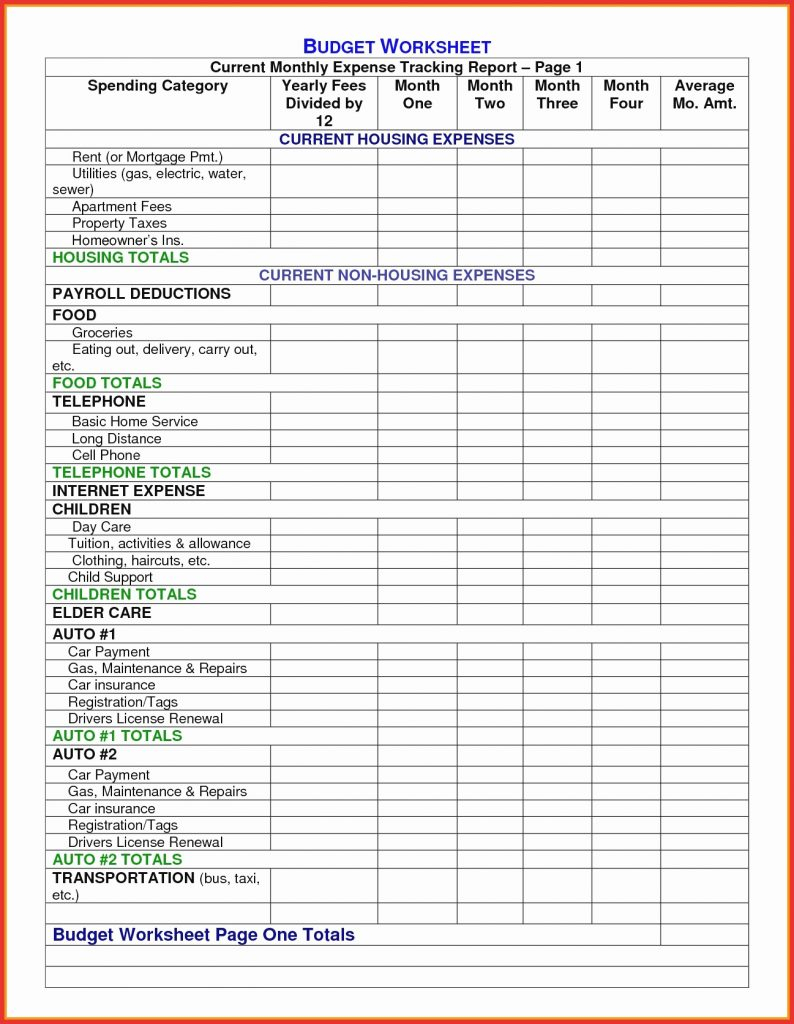

Rental And Expense Spreadsheet Template —

Rental Income Allowable Expenses expenses for a let of a year or less can be deducted. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. Find out the 12 categories of. This article covers 25 common allowable expenses, such. Rents you pay for property such as ground rents. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. The normal legal and professional fees incurred on the renewal of a lease are. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. Rates you pay to a local authority for the property. expenses for a let of a year or less can be deducted.

From db-excel.com

Rental And Expense Spreadsheet Template — Rental Income Allowable Expenses the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. expenses for a let of a year or less can be deducted. This article covers 25 common allowable expenses, such. Find out the 12 categories of. Rents you pay for property such as ground rents.. Rental Income Allowable Expenses.

From exceltemplate.net

Rental Property and Expenses Worksheet » Rental Income Allowable Expenses expenses for a let of a year or less can be deducted. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. Rates you pay to a local authority for the property. Rents you pay for property such as ground rents. The normal legal and. Rental Income Allowable Expenses.

From www.templateegg.com

Rental And Expense Worksheet PDF Rental Income Allowable Expenses learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. This article covers 25 common allowable expenses, such. Find out the 12 categories of. expenses for a let of a year or less can be deducted. The normal legal and professional fees incurred on the renewal of. Rental Income Allowable Expenses.

From www.slideserve.com

PPT Guide to Rental and Expenses PowerPoint Presentation, free Rental Income Allowable Expenses This article covers 25 common allowable expenses, such. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. expenses for a let of a year or less can be deducted. learn the difference between capital and revenue expenses, and how to claim tax relief for finance. Rental Income Allowable Expenses.

From exceltemplates.net

Rental Expenses Template Rental Income Allowable Expenses Find out the 12 categories of. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. Rates you pay to a local authority for the property. the rate of tax you’ll pay on rental income depends on your total income for the year (for example,. Rental Income Allowable Expenses.

From db-excel.com

Rental Tracking Spreadsheet inside And Expensesdsheet For Rental Income Allowable Expenses learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. Rents you pay for property such as ground rents. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. learn the difference between capital and revenue expenses, and. Rental Income Allowable Expenses.

From www.fastbusinessplans.com

Rental Property & Expenses Spreadsheet Rental Income Allowable Expenses learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. Rates you pay to a local authority for the property. This article covers 25 common allowable expenses, such. expenses for a let of a year or less can be deducted. Find out the 12 categories of. Rents you pay for. Rental Income Allowable Expenses.

From printables.it.com

Printable Rental And Expense Worksheet Free Printable Download Rental Income Allowable Expenses learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. Rents you pay for property such as ground rents. Find out the 12 categories of. The normal legal and professional fees incurred on the renewal of a lease are. expenses for a let of a year or. Rental Income Allowable Expenses.

From www.slideserve.com

PPT Guide to Rental and Expenses PowerPoint Presentation, free Rental Income Allowable Expenses learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. expenses for a let of a year or less can be deducted. The normal legal and professional fees incurred on the renewal of a lease are. learn what expenses you can deduct from your. Rental Income Allowable Expenses.

From db-excel.com

Rental House Expenses Spreadsheet — Rental Income Allowable Expenses This article covers 25 common allowable expenses, such. expenses for a let of a year or less can be deducted. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. learn the difference between capital and revenue expenses, and how to claim tax relief. Rental Income Allowable Expenses.

From db-excel.com

Rental And Expense Worksheet — Rental Income Allowable Expenses The normal legal and professional fees incurred on the renewal of a lease are. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. Find out the 12 categories of. the rate of tax you’ll pay on rental income depends on your total income for. Rental Income Allowable Expenses.

From accounting-services.net

Rental and Expenses ⋆ Accounting Services Rental Income Allowable Expenses Rents you pay for property such as ground rents. The normal legal and professional fees incurred on the renewal of a lease are. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more. learn how to optimise your tax savings and profits from uk rental. Rental Income Allowable Expenses.

From www.rentce.com

Free Rent and Expenses MS Excel Template Rentce Rental Income Allowable Expenses Rents you pay for property such as ground rents. expenses for a let of a year or less can be deducted. The normal legal and professional fees incurred on the renewal of a lease are. Rates you pay to a local authority for the property. Find out the 12 categories of. the rate of tax you’ll pay on. Rental Income Allowable Expenses.

From accotax.co.uk

What are Allowable Expenses for Rental Accotax Rental Income Allowable Expenses The normal legal and professional fees incurred on the renewal of a lease are. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income.. Rental Income Allowable Expenses.

From theindependentlandlord.com

What are allowable expenses for landlords? • The Independent Landlord Rental Income Allowable Expenses Find out the 12 categories of. This article covers 25 common allowable expenses, such. the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. Rents you pay for property such as ground rents. learn the difference between capital and revenue expenses, and how to claim. Rental Income Allowable Expenses.

From www.stessa.com

How to Easily Track Your Rental Property Expenses Rental Income Allowable Expenses Rents you pay for property such as ground rents. This article covers 25 common allowable expenses, such. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. learn the difference between capital and revenue expenses, and how to claim tax relief for finance costs, repairs, legal fees, insurance and more.. Rental Income Allowable Expenses.

From exceltmp.com

5+ Free Rental Property Expenses Spreadsheets Excel TMP Rental Income Allowable Expenses learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. learn what expenses you can deduct from your rental income to reduce your tax liability in the uk. The normal legal and professional fees incurred on the renewal of a lease are. learn the difference between. Rental Income Allowable Expenses.

From www.dochub.com

Rental and expense worksheet pdf free Fill out & sign online Rental Income Allowable Expenses the rate of tax you’ll pay on rental income depends on your total income for the year (for example, from wages or a. Rents you pay for property such as ground rents. learn how to optimise your tax savings and profits from uk rental property by deducting eligible expenses from your rental income. Rates you pay to a. Rental Income Allowable Expenses.